Collection Specialists: Expert Financing Recovery Solutions

Our write-up on "Collection Specialists: Specialist Lending Recuperation Solutions" will certainly give you with the understanding you require to understand the value of working with specialist collection professionals. You'll discover concerning the finance recuperation procedure and find reliable approaches for recuperating your loans.

The Importance of Expert Collection Specialists

You need to understand the importance of working with professional collection professionals for effective car loan healing solutions. Expert collection specialists have the understanding as well as experience to handle the ins and outs of lending recovery effectively.

Among the main reasons hiring specialist collection professionals is important is their knowledge in handling overdue consumers. These specialists are fluent in the policies as well as regulations surrounding debt collection, making sure that all actions taken are within legal limits. They know the best strategies to utilize when communicating with customers, boosting the opportunities of successful recuperation.

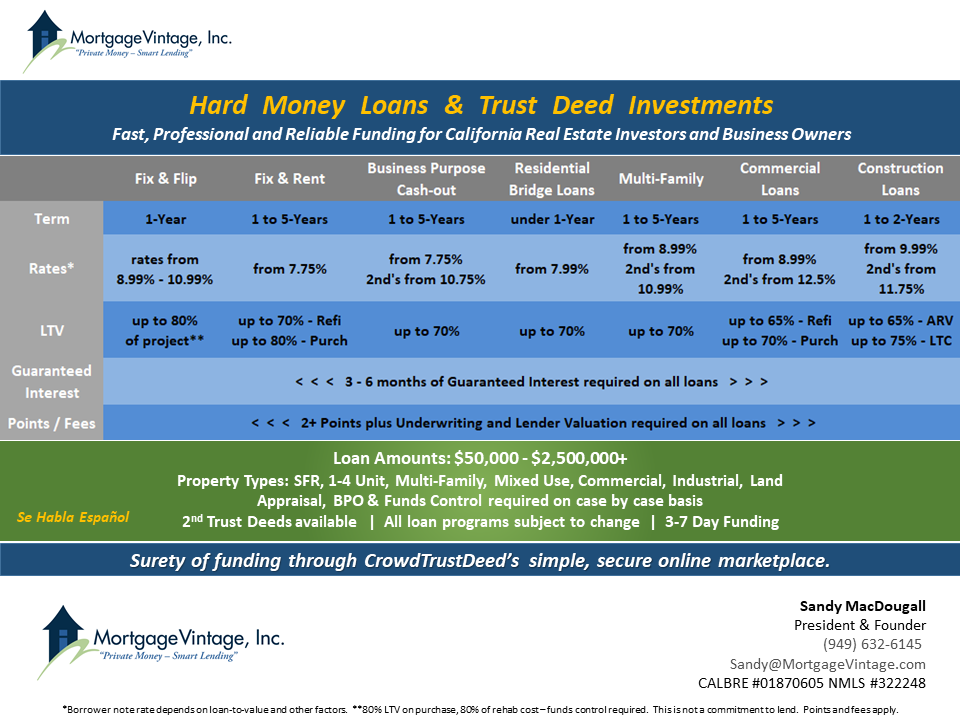

In addition, professional collection professionals have access to sophisticated technology and sources that can enhance the car loan recuperation procedure. They make use of specialized software and devices to track and also handle delinquent accounts effectively. credifin. This assists in recognizing potential threats, creating personalized recovery plans, and making the most of the opportunities of effective results

In addition, by outsourcing loan recovery to professionals, you can conserve beneficial time and also sources. As opposed to dedicating your own staff to chase down overdue consumers, you can focus on core company operations while the collection specialists handle the recuperation procedure.

Recognizing the Lending Recuperation Refine

Comprehending the car loan healing process can be simplified by breaking it down into workable actions. You need to gather all the required info concerning the loan and the debtor.

The following step is to get in touch with the borrower and discuss the outstanding funding. If the customer is unresponsive or unwilling to comply, you may require to escalate the scenario by sending official demand letters or involving a collection firm.

Throughout the lending recuperation process, it's important to record all communication and activities taken. This will help you maintain track of progression as well as provide proof if lawsuit becomes essential. Once the funding has been fully repaid, it's crucial to close the situation as well as upgrade all relevant documents.

Techniques for Efficient Funding Recovery

Throughout the loan recovery process, it's important to maintain open lines of communication with the consumer. By remaining in touch and maintaining the lines of communication open, you can make sure a smoother and also more efficient recovery procedure. When you establish normal call with the borrower, it reveals that you are proactively engaged in settling the issue and also encourages them to comply. It is necessary to be proactive and reach out to the customer routinely, whether it's with telephone call, e-mails, or perhaps in person meetings. By doing so, you can resolve any kind of worries or inquiries they might have, as well as additionally maintain them updated on the progression of the recuperation procedure.

In enhancement to normal interaction, it's also important to listen to the consumer's perspective as well as comprehend their circumstance. By revealing empathy as well as understanding, you can build depend on as well as relationship, which can go a long method in fixing the car loan recuperation.

In general, keeping open lines of communication throughout the finance healing process is critical for a successful result. It aids develop trust fund, encourages teamwork, and also enables a much better understanding of the borrower's circumstance. Keep in mind, reliable interaction is essential to settling any type of concerns and also making sure a positive result.

Conveniences of Hiring Expert Collection Specialists

When hiring experienced experts to manage collections, you can gain from their knowledge as well as knowledge in resolving delinquent accounts efficiently. These professionals comprehend the details of the collection procedure as well as can browse with it effortlessly. With their years of experience, they have actually developed effective strategies to recover exceptional financial debts as well as bring in the payments that are owed to you.

Among the vital advantages of employing collection professionals is their ability to connect properly with borrowers. They have honed their settlement skills and also recognize exactly how to come close to borrowers in a way that urges them to act and also make payments. Their persuasive strategies as well as understanding of debtor psychology can substantially boost the possibilities of effective debt recuperation.

In addition, collection professionals are skilled in the legislations and also guidelines surrounding debt collection. They remain updated on any type of changes in regulation and are knowledgeable concerning the legal civil liberties as well as duties of both the creditor and the debtor. This guarantees that the collection procedure is carried out morally as well as within the borders of the legislation.

By outsourcing your collection efforts to specialists, you can save time and also resources that would or else be spent on training and also managing an internal team. Collection agencies have the essential infrastructure as well as technology to effectively track and handle overdue accounts. They use sophisticated software program as well as analytics to streamline the collection as well as focus on process, optimizing your opportunities of recuperating arrearages.

Ensuring Compliance in Lending Recuperation Practices

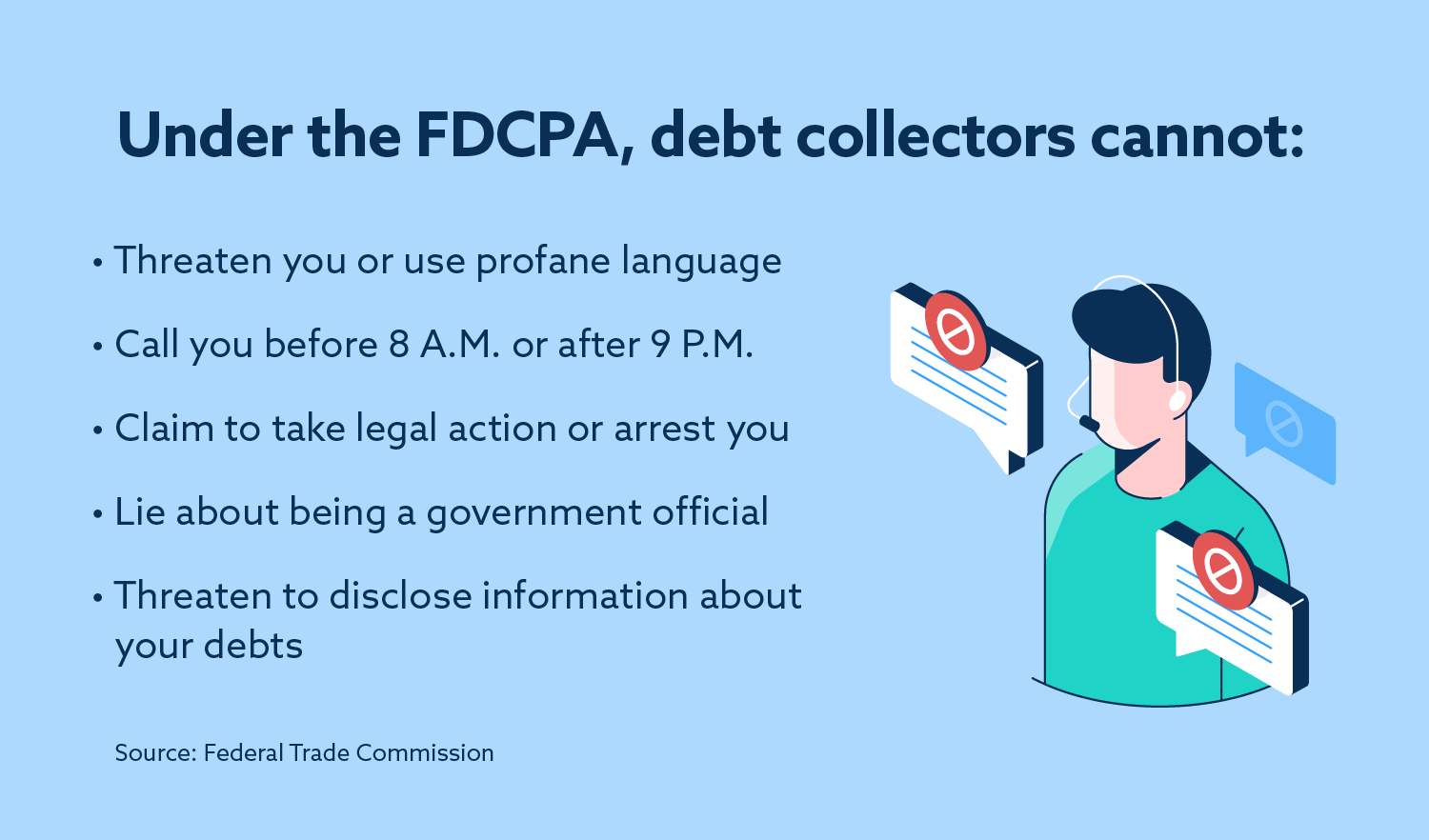

One vital facet of conformity is comprehending as well as carrying out the Fair Financial debt Collection Practices Act (FDCPA). When attempting to recuperate debts, this government regulation outlines the guidelines and limitations that collection agencies must adhere to. Familiarize yourself with the FDCPA discover this as well as make sure that visit our website your team is educated on its needs. This will assist you avoid any kind of infractions that could result in expensive lawful consequences.

Additionally, it's important to keep an eye on any updates or adjustments to state as well as regional regulations, as they might differ from the federal guidelines. These laws can consist of licensing requirements, interest rate restrictions, and specific collection techniques. Staying notified concerning these regulations will certainly help you navigate the intricacies of finance healing and also guarantee that you're adhering to the ideal procedures.

Consistently evaluating your internal policies and procedures is likewise crucial for compliance. Make sure that your group is trained on the standards and protocols you have in location. Consistently audit your procedures to identify any type of locations that require renovation or modification. By continually keeping track of and also upgrading your techniques, you can keep conformity in your car loan recuperation initiatives.

Verdict

So, if you're aiming to recover car loans in the most compliant and effective means feasible, employing professional collection specialists is the way to go. credifin. They have the understanding and abilities to browse the lending recuperation procedure effectively, making use of tested techniques to optimize results. By outsourcing this job to experts, you can focus on various other important aspects of your service while guaranteeing that your lending healing practices remain in line with regulations. Do not hesitate to buy the expertise of collection professionals for a successful lending recuperation journey.

In addition, specialist collection professionals have accessibility to sophisticated modern technology and resources that can simplify the lending recovery procedure.